Acadlore takes over the publication of JCGIRM from 2022 Vol. 9, No. 2. The preceding volumes were published under a CC BY license by the previous owner, and displayed here as agreed between Acadlore and the owner.

Factors Affecting the Perception of Bancassurance: The Case of Malta

Abstract:

Our aim with this study is to delve into the perception of Maltese nationals on bancassurance to establish the drivers which are influencing the purchase of bancassurance and whether these factors can be used by banks to positively impact Maltese nationals’ perception of bancassurance and hence increase their sales and revenues. In order to establish the perception of Maltese nationals on bancassurance, we applied three areas of Customer Perception Theory namely 1) self-perception 2) price perception and 3) benefit/risk perception. To establish the perception of Maltese nationals on bancassurance, the whole population of Maltese nationals was taken into consideration from which a sample of 384 people was taken. In order to carry out the survey, the authors used questionnaires which included a number of demographic questions. The authors also included a number of statements which were divided into the three sections of the Customer Perception Theory. For these statements, the authors used a five point Likert scale ranging from strongly disagree to strongly agree where the participants had to rate the statements according to their level of agreement. The authors also included a comment box to allow the participants to express themselves. The study revealed that various factors are stopping Maltese nationals from purchasing insurance products from banks. Advertisements are not motivating Maltese nationals to purchase insurance products from banks, however they do trust banks and hence they might decide to purchase insurance products from them. The uncertainty of Maltese nationals on the premium charged and whether the costs are reduced when purchasing insurance products from banks shows the lack of knowledge amongst Maltese nationals on bancassurance. On the other hand, the idea of a ‘one-stop-shop’ motivates Maltese nationals to purchase insurance products from banks. This study can serve as guidance for local banks, which are engaged in bancassurance as well as to those banks who intend to engage in bancassurance in the future. This is because this study highlights the factors, which are stopping Maltese nationals from purchasing insurance products from banks. The two main sectors in the financial services industry, which play an important role in the Maltese economy, are the banking and the insurance sectors (Finance Malta, 2018). As far as the authors are aware, this study of the perception of Maltese nationals on bancassurance is the first of its kind conducted in Malta. Hence, other researchers may use Malta as a case study to act as a model to transpose the findings to larger countries.

1. Introduction

As Oosenbrug and Zoon (2012) stated: Europe is getting older. While the ageing population could put pressure on economic growth and welfare provision, it could also open up valuable opportunities for insurers as affluent Baby Boomers head for retirement (p.2).

A survey carried out by the National Statistics Office (NSO) in 2017 found that 18.8% of the total population living in Malta was 65 years old and over. As can be observed in Figure 1, the ageing population in Malta is on the increase (National Statistics Office (NSO), 2018). As people get closer to their retirement age, they tend to realise the need to purchase life insurance or take up a private pension plan (Oosenbrug & Zoon, 2012). The purchasing of these products entails saving money.

Saving money is usually associated with depositing money in a bank account which will eventually lead to the earning of small interest. Instead of depositing money into a bank account, one can also purchase savings life insurance products and hence will have the possibility to earn higher interest than just leaving the money in a bank account (Akrani, 2011).

The purchasing of savings life insurance products is not only possible from insurers but also from banks who enter into agreements with insurers to sell insurance products (Ghimire, 2013). By purchasing these insurance products from banks, one would have the opportunity to have one’s money managed by only one institution rather than having to source multiple entities. (Teunissen, 2008).

The term ‘bancassurance’ was first used in France and it is a combination of two words; ‘banc’ and ‘assurance’ which refers to the selling of insurance products using the bank’s client base. Bancassurance which is also referred to as ‘allfinanz’ involves a package of financial services that can satisfy the customer’s needs with resepct to banking and insurance (Ghimire, 2013).

Gonulal, Lester & Goulder (2012) defined bancassurance as the process of using a bank’s customer relationships to sell life and non-life insurance products and it is emerging as a natural pathway for the effective development of insurance.

Due to the globalisation of the economy and other factors such as the enhanced use of technology, the insurance market is one of the main markets which helps the banking sector to continue to expand and develop at a faster rate (Clipici & Bolovan, 2012). This will lead to a point where a bank can sign an agreement with an insurance company to sell the latter’s products earning an additional stream of revenues and hence increase its profits (Shah & Salim, 2011).

Once the bank and the insurer enter into the agreement of bancassurance, both will benefit (Fields et al., 2007 b). The main benefit for both institutions is that banks will earn an additional stream of revenue by charging a fee to the client when purchasing an insurance product from the bank while the insurer will expand its customer base without the need to increase sales or pay broker’s and agent’s commission (Ghimire, 2013). Additionally the customer benefits by having access to a range of both financial and insurance products from a ‘one-stop-shop’ (Francis, 2014).

Over the years the Maltese population has been choosing bancassurance rather than other distribution channels to purchase life insurance. From Figure 2 below, it can be noted that between 2011 and 2013 the Gross Written Premium (GWP) has decreased from 82.2% to 78.8% followed by an increase to 81.9% in the years 2014 and 2015. As a second option to bancassurance, people prefer to purchase life insurance products from agents, followed by brokers and direct insurers respectively (Insurance Europe, 2018 b). It is important to note that Maltese banks cannot sell non-life insurance products. These products can only be sold by insurance companies (Buttigieg, 2014).

In the Maltese economy, the financial services industry plays an important role where its two main sectors are the banking and the insurance sectors (Malta Financial Services (MFSA), 2017). Since bancassurance was introduced in Malta, a number of studies have been carried out. However, as far as the authors know, a study on the perception of the Maltese population on bancassurance has never been carried out.

Therefore, by means of this study, the authors objective is to understand the perception of Maltese nationals and identify the main influencing factors on the purchase of bancassurance and whether these factors can be used by the banks to positively impact the Maltese nationals’ perception on bancassurance and possibly increase their sales and revenues.

Malta is a small island in the Mediterranean Sea which lies between Europe and North Africa. It is one of the world’s smallest islands, with a population of around 475,000 inhabitants. It is a member of the European Union and the Eurozone (Finance Malta, 2014). A major contributor to the Maltese economy is the financial services industry where its two main sectors are banks and insurance companies (Finance Malta, 2018). As noted from Figure 3, the choice of bancassurance over other distribution channel to purchase life insurance products by Maltese nationals has been increasing continuously (Insurance Europe, 2018 b). Therefore, enhancing the bancassurance concept in Malta will arguably lead to a greater expansion in the financial services industry, given that bancassurance is the merger of a bank and an insurance company.

Case studies conducted in small islands such as Malta have been used by various researchers who used small islands as a laboratory experiment for use in larger regions (Bezzina et al., 2014). According to Bezzina et al. (2014) there are a number of characteristics on Malta’s financial system and history which makes studies on the financial system more interesting. Specifically:

1. Malta’s governmental and administrative structure is similar to that of Great Britain. Unlike other small islands, Malta adopts a centralised system of government with strong and different political parties and a national Constitution that makes provisions for a number of scrutinizing agencies (Pirotta, 2001).

2. Malta has an outsized banking sector despite its size.

3. Malta’s financial centre includes six strong domestic banks.

4. During the 2008-2009 financial crisis there were no bailouts in Malta as opoosedto other countries in Europe (Bezzina et al., 2014).

In her study, Bugeja (2017) stated that the mentality of Maltese nationals with regards to banks is that banks are institutions which only offer financial products. However, Bugeja (2017) is convinced that by identifying the perceived factors that are influencing the purchase of bancassurance, banks would use them to positively impact Maltese nationals’ perception regarding this matter and possibly increase their sales. All of this will eventually improve the concept of bancassurance in the local market (Bugeja, 2017).

With this study we aim to determine the following :

1. What are the perceived factors influencing the purchase of local bancassurance?

2. Can these factors be used by banks to positively impact the Maltese nationals’ perception of bancassurance and possibly generate more sales?

2. Literature Review

The traditional view of banks and insurance companies is that banks handle funds whereas insurance companies take risks. The main similarity between the two is that they form part of the financial services industry. Various authors have put forward the idea that these two sectors have more similarities than differences (Genetay & Molyneux, 1998).

The main function of a bank is to accept deposits and give out loans whereas the main function of an insurance company is to provide financial protection in case an insured unexpected event occurs to the subject matter being insured by the policyholder (Gumbel, 1990).

An important distinction that Delporte (1991) emphasized was about the term of the savings. The banking industry offers short term and medium term savings whereas the insurance industry offers long term savings. Another important distinction is the area of specialisation where banks are responsible for handling and managing funds whereas insurance companies are responsible for handling risks (Levy- Lang, 1990).

Fields et al. (2007b) argued that banks and insurance companies are both financial intermediaries that pool savings of individuals which are transferred to capital expenditure.

Lewis (1990) argued that in portfolio management, banks take advantage of economies of scale arising from the law of large numbers. This means that as deposits withdrawals do not affect the other depositors. Insurance companies rely on the law of large numbers which states that as the sample grows, the expected loss distribution will become closer to the true loss distribution (Cummins, 1991). This enables insurance companies to pool reserves to protect against any losses that might occur. Similar to insurance companies, banks provide insurance of financial security for their clients where the premium includes the service charges and the spread between interest rates charged on loans and interest rates paid on deposits (Lewis, 1990).

Banks and insurance companies are both involved in fund management and risk bearing. Moreover, both banks and insurance companies can be seen as complementary to each other. This is because when a bank gives out a loan to an individual, the bank requires the individual to purchase several insurance products such as life insurance and income protection insurance to protect against any losses. This means that if something unexpected happens to the borrower, the bank will be granted the sum assured and hence the loan will be paid out. Therefore, if the individual does not have any insurance products backing up the loan and an unexpected event occurs where the individual cannot pay the loan, the bank will lose the money. To summarise, this means that banking and insurance products provide a means of savings and insurance (Genetay & Molyneux, 1998).

Bancassurance was introduced in France in the 1980’s with the mergers of banks and insurance companies. Throughout the years, these mergers have been continuously increasing. However, due to legislative restrictions in the US, banks and insurance companies could not enter into this new line of business there. However, in 1999 the Gramm-Leach-Biley Act was introduced where deregulation took place. Consequently, the US banks and the US insurance companies could enter into the bancassurance market by forming a financial holding company also known as universal bank (Fields et al., 2007 b).

For a better understanding of the development of bancassurance, one must refer to the framework introduced by Daniel in 1995 describing the evolution of bancassurance products. With reference to other European countries, Daniel’s (1995) framework is based on the French market (Genetay & Molyneux, 1998). Daniel (1995) divided his framework into three periods: before 1980, after 1980 and around 1990, as shown in Table 1.

1980’s | 1990’s | ||

Products | Extension of banking | Savings products classified as life assurance | Diversification Supply: Pure life and complex financial products |

In the first period, before the 1980s, the products sold by the banks as a direct extension of their activities were not associated with insurance such as credit insurance. According to Daniel (1995), the second period started around 1980 when banks started to produce and sell different financial products. Hence, it is believed that the growth of bancassurance originated here. In this period, banks began to exploit capitalisation products such as endowment contracts whereby the policyholder would get the lump sum at maturity if the policyholder is still alive (Fields et al., 2007 a). Hence, one can note that although there is an element of insurance in these products, there is also an element of savings. According to Pitt (1990), many analysts observed that these products where merely bank products rather than insurance products (Hoschka, 1994).

Daniel (1995) described the third period as ‘crucial’ in the development of bancassurance. During this time, banks started to move forward and tried to be innovative by developing more complex products to satisfy customer needs. They came up with unit linked and investment linked policies and pure life insurance products (Hoschka, 1994).

This overview of the development of bancassurance highlights the various forms of bancassurance models. Over the years, bancassurance has been expanding, embracing both the distribution and the production of insurance. Moreover, the evolution of bancassurance led to a customer-driven approach in the context of financial products (Genetay & Molyneux, 1998).

The type of bancassurance model chosen depends on several factors such as the social-economic environment, the regulatory environment, the cultural environment and customer choice. The main bancassurance models are the distribution agreement, the strategic alliance agreement, the joint venture agreement and the full integration agreement (Teunissen, 2008). The authors will now present each model in turn.

In this type of agreement, the bank acts as an intermediary for one or more insurance companies to sell their insurance products. This agreement can either be integrative, where the bankers do the sales, or specialist, where the insurers do the sales to prospect leads provided by private client bankers (Teunissen, 2008).

Usually, the insurer pays a commission to the bank where in turn the bank charges fees to the policyholders. The main advantage to the bank of this agreement is that the operations start forthwith without the need to make major capital investments. Also, the insurer provides product training, marketing and sales training. The disadvantages of this agreement are the lack of flexibility to launch new products and the possibility of differences in the corporate culture (Teunissen, 2008).

The entry of Markets in Financial Instruments Directive II (MIFID II) influenced the business models of banks whereas the entry of Insurance Distribution Directive (IDD) forced insurers to change their business models. These directives are relevant to those banks and insurers which are providing or distributing the product. Hence the bancassurance concept is also affected by both regulations (Riesner & Seidler, 2017).

2.1.1.1 Insurance Distribution Directive (IDD)

The IDD is a replacement of the Insurance Mediation Directive (IMD) to regulate the way insurance products are designed and sold by insurers and insurance intermediaries (European Insurance and Occupational Pensions Authority (EIOPA), 2018). The IDD aims to ensure minimum harmonisation of insurance distribution regulation across the EU. By creating a level playing field when purchasing insurance products, this directive enhances consumer protection and provides effective competition (PWC, 2018).

The IDD introduced new requirements in new areas such as enhanced conduct rules for insurance-based investment products and product oversight and governance (Financial Conduct Authority (FCA), 2018). In a nutshell, this directive includes all the information that should be provided to customers before signing an insurance contract. Specifically, it includes conduct of business and transparency rules that should be imposed on the distributors, as well as the rules and procedures for the distributors when doing cross-border business and the rules for the supervision and sanctioning of insurance distributors in case they breach the provisions of the directive (European Insurance and Occupational Pensions Authority (EIOPA), 2018).

2.1.1.2 Markets in Financial Instruments Directive II (MIFID II)

The major area under MIFID II is product governance where for each product the distributor must define the target customers. Therefore, the European regulators must encourage the distributors to work closely with the manufaturers (KPMG, 2017). To define the target market the European Securities and Markets Authority (ESMA) have put forward five criteria: the client type, the client’s knowledge and experience, the client’s financial situation and ability to bear losses, the risk tolerance and compatibility of the risk/reward profile of the product with the target market and the client’s objectives and needs (PWC, 2017). For reasons of hedging and diversification, a product can be sold outside its intended client base (Catala, 2017).

Contrary to the distribution agreement, the strategic alliance agreement is an agreement between a bank and one insurance company only. The main advantage of this agreement for the bank is the ability to choose the best insurance company while for the insurer the main advantage is the ability to expand its customer base without increasing the sales or paying agent or broker commissions. (Teunissen, 2008).

In the joint venture agreement, the bank and the insurer enter into a partnership agreement and a new entity is formed. The advantages of this agreement include cross selling opportunities and earning additional revenues through commissions. Both the bank and the insurance company have rights based on the decisions taken according to their equity contribution in the new company formed (Clipici & Bolovan, 2012).

In the full integration agreement, the bank creates its subsidiary. Hence, the bank sells the insurance products under its own name. The disadvantage of this agreement is that the bank needs to make a substantial investment to create the subsidiary. Also, the bank has to provide all the necessary training, IT infrastructure and establish its marketing plan to sell the insurance products (Clipici & Bolovan, 2012).

Bancassurance agreements differ from one country to another. In the US, the distribution agreement is more popular, while in Europe the strategic alliance agreements and the joint venture agreements are the most commonly used. (Teunissen, 2008).

There are several reasons which contribute to the need for bancassurance and hence to the growth of bancassurance. The reasons are:

· Fee income – A bank is expected to increase its fee-based income and overall productivity by leveraging its brand image, branch network and client base (Francis, 2014). By acting as a ‘one- stop-shop’ with these value added services, the bank increases the customer’s satisfaction (Alavudeen & KD, 2015).

· Cost effective – For the insurance company it is more cost effective since there will be no agency costs (Francis, 2014).

· Conductive environment – Due to changes in lifestyle and in culture, the need for bancassurance has increased. Such changes include the use of the internet and the efficiency and effectiveness of technology, the need for private pension plans and the idea of a ‘one-stop-shop’ to provide all financial services from a single location (Sinha, 2005).

· Innovative and efficient – When a bank and an insurance company enter into a bancassurance agreement, this leads to an innovative financial service because of the mix of their skills and corporate cultures (Allen, 2018).

· Fund management – Investment preferences changed because nowadays, customers prefer to purchase life insurance products or invest in mutual funds rather than depositing in a savings account because the return is higher (Munich Re, 2001). Since purchasing a life insurance product is considered as savings, banks entered into this line of business because of the opportunity to increase its deposits by offering such products. Also, for the bank, selling life and non-life insurance products provides an additional stream of revenue besides the fee income (Teunissen, 2008).

When a bank gives out a loan to its customers there is a lot of risks involved especially default risk. However, the bank can insure this default risk by entering into a long term strategic alliance with the insurance company, so that the bank would grant a credit insurance policy to the customer (Ghimire, 2013).

In 2008, Corneliu & Ghilimei emphasized that banks mainly generate profits from interest-bearing instruments hence the interest spread, which is the difference between the interest rate that they pay on deposits and what they charge on loans. However, since insurance products do not generate any interests, the bank can earn additional revenue by generating non-interest income from the selling of the insurance products (Clipici & Bolovan, 2012). Additionally, when banks sell these products they charge a fee mainly for the administration expenses hence they also earn a fee income (Ghimire, 2013).

Through bancassurance, banks have access to a larger product range to sell. Hence, as Kavugwi (2015) stated, the bank is more attractive and customer satisfaction and loyalty increases. According to Bergendahl (1995) any bank that would like to increase its volume and improve efficiency needs to expand its products and services. From the point of view of customers, banks are seen as a ‘one-stop shop’. Therefore, thanks to this idea banks increase their network size (Ghimire, 2013).

Kumar (2017) argued that as the insurer enters into bancassurance, this expands its customer base without increasing its sales or pay broker’s and agent’s commissions. When choosing a bank, the customer must have complete confidence in the bank since they are going to trust their money to a third party. Therefore, the insurer is going to benefit from this confidence and the bank’s trustworthy image (Ghimire, 2013).

Distribution costs decrease since only one member of personnel needs to be available to sell the insurance products. Also, by using the bank’s existing network, the insurer can establish itself more quickly in a new market (Ghimire, 2013).

Constantinescu (2012) argued that due to the partnership with the bank, the insurer increases its efficiency to develop new products. Also, the insurer increases its capital to develop its business.

The customer is also a stakeholder who benefits from bancassurance. This is because the customer can have access to a variety of products under one roof, hence the concept of a ‘one-stop-shop’ (Francis, 2014). Customers also benefit from lower premium rates and new products that would not be available had the bank and the insurance company not been working together. Therefore, customer satisfaction increases (Ghimire, 2013).

Since the concept of bancassurance is all about the merging of banks with insurance companies, this merger decreases systemic risk. This means that banks benefit from lower income volatility while insurers would increase their capital to maintain solvency capital requirements (SCR) (Corneliu & Ghilimei, 2008).

The main type of distribution channel that insurers use is either brokers, agents or bancassurance. The type of distribution channel varies from one country to another because it depends on the customer’s needs and preferences as well as on the culture of the country. This ensures better customer satisfaction as well as stimulating competition between providers and distributors in the price and quality of products (Insurance Europe, 2016).

The next section describes the selling of insurance products through the different types of distribution channels in the European market.

As can be seen in Figure 3, in 2014 the main type of distribution channel for life insurance products was bancassurance followed by agents, brokers and direct writing. Among the largest life insurance markets, the countries which sold the largest number of insurance products through bancassurance were Italy, which sold 79% of the GWP, followed by France, which sold 64% of the GWP. On the other hand, the country which sold the largest number of insurance products through agents and brokers was the UK, which sold 79% (Insurance Europe, 2018 a).

The other European markets in which bancassurance was the most dominant were Malta which sold 82%, Portugal and Turkey which sold 80% each and Spain, which sold 63%. The market in which both agents and brokers were dominant was Bulgaria, which sold 80%. It is important to note that agents alone were the main distribution channel in Slovenia, which sold 80% and Slovakia, which sold 66% (Insurance Europe, 2018 a).

In the countries mentioned earlier, bancassurance is the most dominant distribution channel because of several reasons. Firstly, when this concept was introduced (in the 1980s), insurance companies had a low penetration ratio while the banking sector held a strong position. Also, it is dominant because the customers benefit from the ‘one-stop-shop’ effect which means a customer can buy several products from a single provider (Clipici & Bolovan, 2012).

In the UK and Germany, the bancassurance concept cannot develop because when this concept was introduced, the insurance sector had a good penetration ratio, hence the insurance sector was strong enough and this new concept didn’t make any difference. Also, countries like the UK have low bank density, thus rendering it difficult to sell insurance products through banks. The reason why bancassurance is rare in countries like Slovakia and Slovenia is because of the slow growth of the life market in these countries (Clipici & Bolovan, 2012).

Irrespective of how large the market is, non-life insurance policies are mainly sold through agents and brokers. As can be seen in Figure 4 among all European markets, Italy and Slovakia had sold 79% of non-life insurance products through agents followed by Turkey, which sold 66%, Slovenia, which sold 65%, Poland, which sold 61%, Germany, which sold 59% and Portugal, which sold 54%. On the same line, Belgium, the UK and Bulgaria had sold 61%, 52% and 50%, respectively, through brokers. It is important to note that Croatia was the top country which sold 63% of non-life insurance products directly (Insurance Europe, 2018 a).

Due to changes in customer needs, preferences, regulatory and technological changes, distribution channels are always moving forward. Insurance companies are always trying to innovate by investing in new technologies to exceed the customer’s expectations and sell insurance products which satisfy the customer’s needs and preferences. New EU legislation like the IDD and the Packaged Retail and Insurance-based Investment Products (PRIIPs) regulation is likely to impact distribution channels (Insurance Europe, 2018 a).

In Malta, bancassurance was first introduced in 1994 with the joint venture of Bank of Valletta (BOV) and Middlesea Insurance. This joint venture led to the creation of a new company namely Middlesea Valletta Life Assurance Co Ltd. The equity of this joint venture was held by Middlesea Insurance which had 51% of the equity, BOV which had 39%, while the remaining 10% were held by Munich Re. In 2005, BOV acquired the 10% equity from Munich Re and 1% from Middlesea Insurance. In 2010, Middlesea Valletta Life Assurance Co Ltd changed its name to MSV Life p.l.c. At this point, all equity of MSV Life was acquired by Mapfre Middlesea and BOV each holding 50% of the equity. In 2016, MSV Life p.l.c. changed its name to MAPFRE MSV Life p.l.c (MAPFRE MSV Life, 2018).

In 1996, Mid-Med Bank formed its own subsidiary with the name of Mid-Med Life Assurance Malta Ltd to start selling life insurance products. In 1999, HSBC bought 70% of Mid-Med Bank equity, hence Mid-Med Life Assurance Ltd changed its name to HSBC Life Assurance Malta Ltd. (HSBC, 2018). APS bank has also entered into bancassurance. In particular it entered into a distribution agreement with MAPFRE MSV Life to start selling life insurance to its clients.

The Second Banking Directive (89/664/ECC) removed the existing barriers between different sectors of the financial services industry so that a credit institution can sell both financial and insurance products. Hence, this directive eventually changed the bancassurance concept (Ricci, 2011). Since Malta is a member of the EU, it had to transpose this directive into the Maltese laws and regulations.

The local banks are authorised to sell insurance products authorby the MFSA. The banks which act as an intermediary of an insurance company are all regulated under the Insurance Distribution Act, Chapter 487 of the Laws of Malta (Laws of Malta, 2018). On the other hand, the Insurance Business Act 1998 regulates the joint venture model and the full integration model since a new insurance company would have been formed (Laws of Malta, 1981). Under these regulations, local banks can only sell life insurance products. However, in 2006, the MFSA issued a circular entitled ‘Credit and Financial Institutions – General Business Insurance’ stating that these banks can also sell accident, sickness and miscellaneous financial loss insurance when granting a loan to someone (Buttigieg, 2014).

Ward, Grinstein & Keim (2015) defined perception as: The process of recognising (being aware of), organising (gathering and storing), and interpreting (binding to knowledge) sensory information. Perception deals with the human senses that generate signals from the environment through sight, hearing, touch, smell and taste. Vision and audition are the most well understood. Simply put, perception is the process by which we interpret the world around us, forming a mental representation of the environment (p.73).

Walters & Bergiel (1989) define customer perception as the process where the customer becomes aware of the environment and interprets it in a way that fits into a frame of reference (Hojdik, 2018).

The main aim of a company is to increase its sales and revenues and to understand the customer behaviour by getting to know the customer’s needs and the decision process involved in the purchase of products or services (Hojdik, 2018).

Based on the purchasing experience of a product or service, the customer forms opinions on the company hence influencing the customer perception process (Hojdik, 2018). As shown in Figure 5, the customer perception process is divided into five stages namely (1) exposure, (2) attention, (3) organisation, (4) interpretation and (5) retention. These stages will enable the customer to take the ultimate decision to purchase the product or service (Mostert, 1996).

2.7.1.1 Exposure

The first stage of the perception process is exposure. This is the recognition of a stimulus which comes within the range of one’s senses (Rookes & Willson, 2005). This can either be intentional or accidental exposure. Intentional exposure is the exposure to market related information because of one’s personal interests while accidental exposure occurs when one is continuously exposed to marketing campaigns such as advertisements on the internet (Mostert, 1996).

2.7.1.2 Attention

From a marketing perspective, attention is very important to companies. This is because every day, the customers are exposed to marketing stimuli. Hence, if the customers do not pay attention to these marketing stimuli, the message that the company tries to portray becomes pointless (Mostert, 1996).

Aaker et al. (1987) described attention as an information filter because it is a type of mechanism which controls the amount of information that one can receive (Mostert, 1996). There are various factors which determine attention (BBA|MANTRA, n.d.). These are:

1. Stimulus factors – These are the physical characteristics of a stimulus (BBA|MANTRA, n.d.).

2. Size and intensity of the message – In the perception process, the size of a stimulus has a great impact because it influences attention and recognition. Similarly, the more intense a stimulus is, the higher the probability that it will be perceived. As such, marketers often use intensity to attract the customer’s attention (Human Resource Management, 2009).

3. Situational factors – These are the external environment and temporary characteristics of an individual. This means that the interpretation of a stimulus can be affected by the location, social context and timing of a stimulus (BBA|MANTRA, n.d.).

4. Psychological factors – These are the psychological factors of the individual which include attitudes, moods, motivation, interest and expectations (Bhowmik & Naveed, 2012).

5. Colour, movement and contrast – The way the stimulus is presented gets the customer’s attention. An individual will get the attention of a stimulus if a stimulus contrasts with its surrounding environment. This can be caused by presenting the stimulus in bright colours (Human Resource Management, 2009).

2.7.1.3 Organisation

According to Gestalt psychology, customers organise stimuli into groups and perceive them as unified wholes (Mostert, 1996). In order to form a picture of the perceptions, customers tend to organise these perceptions into figure and ground relationships. In a marketing perspective, when a company wants to advertise a product or service, it designs its advertisement into symbols and figures (BBA|MANTRA, n.d.).

2.7.1.4 Interpretation

Schiffman et al. (1991) and Van der Walt (1991) argued that the interpretation stage is different for every individual since it is based on past experiences. Mowen (1993) added that the interpretation of a stimulus is retrieved from long-term memory and due to different expectations, different interpretations of the same stimulus can exist (Mostert, 1996).

The interpretation stage is made up of two principles: categorisation and inference. The categorisation principle helps the customer to process known information quickly and efficiently and to classify new information accordingly, while the inference principle is the development of an association between two stimuli (Mostert, 1996).

2.7.1.5 Retention

In order for the customer perception process to be successful, the customer needs to develop all of this process into a memory which can be recalled when necessary. Since customers are continuously exposed to a lot of marketing stimuli, there is a tendency to forget most of them. Hence, in order to retain these marketing stimuli, the message that the company wants to portray must be continuously repeated otherwise it will be futile (Fripp, n.d.).

Customers have their own perception of a product or service. customer perception theory is about analysing the customer’s behaviour and understanding the reason(s) for purchasing products or services (Blank, n.d.).

When studying customer perception theory, the authors tried to understand what motivates the customer to take such decisions and how these decisions are influenced by them. Usually, companies use this theory to enhance their internal strategies (mainly marketing and advertising strategies) and to attract new customers (Flamand, 2017).

Ndubisi (2003) argued that a company has a social responsibility to provide the goods and services which satisfy the customers requirements and in turn customers present ideas, opportunites and money amongst others. Once the customers present their needs and wants the company will satisfy such needs by providing them with an adequate products or services andif the company does not meet these needs, it will lead to customer dissatisfaction (Ndubisi, 2003).

In their studies, Flint, Woodruff & Gardial (1997) proposed that in order to compete, companies need to understand the changes in the customer’s perception values. Therefore, companies must come up with strategies to maintain their competitive advantage and retain their current customers.

The Customer Perception Theory is divided into three:

1. Self-Perception

2. Price Perception

3. Benefit/Risk Perception

2.7.2.1 Self-Perception Theory

Self-perception theory was first introduced in 1965 by Psychologist Daryl Bem. Bem (1967) proposed that the self-perception theory is an alternative to the cognitive dissonance theory which was proposed by Leon Festinger. According to Bem (1967), provided that an attitude has not yet occurred, people develop a new attitude by observing their own behaviour and hence, conclude what attitudes must have caused this behaviour (Bem, 1967).

This theory is mainly used for psychological therapy and in marketing to persuade customers.

2.7.2.1.1 Psychological Therapy

In psychological therapy, self-perception theory suggests that the individual’s inner feelings are derived from their external behaviours. If these external behaviours are abnormal, people will engage these abnormalities to their poor abilities and hence suffer from psychological problems. Therefore, self- perception theory can be used to help those who have psychological problems arousing from any abnormality by first teaching them to change their behaviour and then how to deal with the problem (Bem, 1972).

2.7.2.1.2 Marketing

Self-perception theory is also used as a marketing tool to persuade customers. The most widely used technique is the foot-in-the-door technique. The idea of this technique is to convince a customer to agree to something small, which eventually will lead the customer to persuade himself/herself to agree to the larger request that the company had in mind. The idea of this technique is that by persuading the customer on a small request, he/she will change his/her own mind and agree on a larger request. Hence, by observing a customer’s behaviour, the purchasing of a product or service may result (Snyder & Cunningham, 1975).

2.7.2.2 Price Perception Theory

Price perception theory determines the customer’s perception of whether one was charged a fair price or not when purchasing a product. It includes the quality of the product or service that the company is offering and the ability to compare a company’s prices with other companies. It also includes the customer’s satisfaction upon purchasing the product and whether they would purchase further products (Blank, n.d.).

Janiszewski & Lichtenstein (1999) argued that price perception is all about the customer’s attraction to a price. They also added that customers are attracted to a price if they are able to compare the price with an internal reference price. The attractiveness of a price may also depend on the ability to compare a price to the endpoints of the recalled price change. In a study carried out by Janiszewski and Lichtenstein (1999), it was shown that changes in the context can bring about changes to the recalled price range which eventually will lead to a change in the perception of the price.

2.7.2.3 Risk/Benefit Perception Theory

The aim of a company is to convince the customer that the product or is right and adequate for them. Hence, the company increases its sales and revenues. However, customers tend to reject unsupported claims and often like to seek further information on the products or services that they are considering purchasing (Blank, n.d.).

2.7.2.3.1 The Benefits of the Customer Perception Theory for Business

The perception of a product or service of the company might be different from that of the customer. Due to an increase in competition, companies might face a challenge in differentiating their products or services from that of other companies. Therefore, to attract customers, companies would end up lowering their prices along with minimising the product differences (iResearch Services, 2018).

Nowadays, customers are constantly seeking branded products and discounts. Through the internet, customers can compare prices more easily and their awareness and expectations have increased. This has put companies in a challenging position as they need to sort their products by quality, price and function (iResearch Services, 2018).

Therefore, to solve this problem, companies must form a strong relationship with the customer. The better the relationship a company has with its customers, the more likely the customer would purchase other products or services from that company. However, if there is a weak relationship, arousing from a single transaction, it is likely that the customer would not return back to make another transaction. Therefore, the main aim of a company is to convince the customer to purchase their products or services from them as they would lose out on benefits when buying the competitor’s products or services (iResearch Services, 2018).

Throughout the years, the bancassurance concept has been continually expanding. Although bancassurance in Malta is on the increase (Insurance Europe, 2018 b), there are factors which are influencing the Maltese people’s perception of the purchase of bancassurance (Bugeja, 2017).

3. Methodology

According to Yin (2002), in order to answer the research question, data analysis must be all about examining, categorising, tabulating, testing or combining quantitative and qualitative data. On the other hand Stake (1995) argues that data analysis is a matter of giving meaning to first impressions as well as to final compilations (Stake, 1995).

A researcher can use various ways to collect information from respondents. For the purpose of this research, the authors used a mix approach and constructed a questionnaire to conduct a survey amongst Maltese nationals.

To carry out the survey, the authors created a number of demographic questions to gain an idea of who the respondents were. The demographic section included a question about the gender, whereby participants were asked to choose between males, females, other or prefer not to say. The participants had to state their age by choosing from five different age brackets, namely 18-24 years old, 25-34 years old, 35-44 years old, 45-54 years old, 55-64 years old and 65+ years old. Another question required the participants to state whether they had ever heard the term ‘bancassurance’ before. If in the affirmative, they were asked to identify the source, choosing from media, friends/relatives, bank personnel, agents/brokers/intermediaries, school, work or other. The last question was whether the participants are bancassurance clients or not.

The authors divided the questionnaire into three sectionsnamely-perception, price perception and benefit/risk perception. Under each section, five different statements were created.

Under the self-perception section, the statements were:

1. “Advertisements on the TV, radio and social media motivate me to purchase insurance products from banks.”

2. “I have good trust in my bank therefore I might buy insurance products that the bank will offer.”

3. “I will buy insurance products from my bank because the bank better understands my needs and financial position.”

4. “I will only buy insurance products from the bank if the bank obliges me to do so (when taking out a home loan, for instance, the bank obliges you to purchase life insurance for the term of the loan) otherwise I am not going to buy insurance products from the bank.”

5. “I prefer to buy insurance products from the bank because of its brand image and it is well known.”

Under the price perception section, the statements were:

1. “I think that the premium charged for purchasing an insurance product, such as life insurance or set up a private pension plan, is fair and reasonable.”

2. “I think it is economical to purchase insurance products through banks.”

3. “I think that costs are reduced when buying insurance products through banks.”

4. “I will buy insurance products from banks because I am satisfied with the bank’s services.”

5. “I think that the processing time to purchase an insurance product from a bank is quick and efficient.”

Under the benefit/risk perception, the statements were:

1. “I think it is convenient to purchase insurance products from banks.”

2. “The idea that I will have access to both financial products and insurance products from one institution only (one-stop-shop) motivates me to purchase such products from banks because it will save me time.”

3. “I think that through bancassurance, the process of a claim settlement takes too long.”

4. “Setting up a private pension plan gives me peace of mind that after retirement I will have enough money to live.”

5. “Purchasing life insurance gives me peace of mind that if I die my dependents will have financial protection.”

For these statements, the authors used a five point Likert scale '1'- being strongly disagree, '2' being disagree, '3' being neither disagree or agree, '4' being agree and '5' being strongly agree. The participants had to rate the above statements according to their level of agreement.

The authors opted for a five point Likert scale because it does not simply expect participants to answer yes or no. Rather it allows participants to express both the direction and strength of their opinion about a topic (Garland, 1991). However, the validity of a Likert scale can be reduced due to social desirability where the participants do not answer truthfully (McLeod, 2008).

At the end of the questionnaire, the authors included a comment box to allow the participants to express themselves by writing any additional comments.

According to Suresh et al. (2011), the main purpose of sampling is to ensure that the sample group represents the target population without any errors. Since this study is done on the perception of Maltese nationals on bancassurance, the whole population taken into consideration was Maltese nationals, which amounts to 475,000 people. Hence, using Raosoft a sample size calculator with a margin error of 5%, 95% confidence level and a population size of 475,000, the sample size calculator recommended a minimum sample size of 384.

In order to obtain a sample of the Maltese population, the authors used probability sampling. Maltese nationals were randomly selected meaning that every national had an equal chance of being selected and participating in the survey (Saunders et al., 2009). Gravetter & Forzano (2018) stated that the logic behind simple random sampling is that it removes bias from the selection procedure and should result in a representative sample (Gravetter & Forzano, 2018).

The survey was created on SurveyMonkey® and was shared through Facebook where 192 participants had been invited to fill in the survey online. They were also asked to invite others. The remaining 192 surveys were printed as a hard copy and were distributed randomly to Maltese nationals.

After the questionnaires were filled in by the participants, the authors used IBM SPSS version 25 to input the participants’ data and analyse their respective answers. To analyse the data, the authors used descriptive statistics, the Kruskal-Wallis test and a thematic approach as suggested by Braun et al. (2006).

To indicate the centre of distribution, the authors used the arithmetic mean (M). As pointed out earlier, the scale used for this research ranges from 1 to 5. Hence, in order to establish in which range the arithmetic mean falls (Table 2), the mean value range for each statement was calculated using the equation:

Mean Value Range $=\frac{\text { Range Value }}{\text { Number of Classes }}$

Range | Interpretation |

1.00 – 1.80 | Strongly Disagree |

1.81 – 2.60 | Disagree |

2.61 – 3.40 | Neither Disagree nor Agree |

3.41 – 4.20 | Agree |

4.21 – 5.00 | Strongly Agree |

Therefore, by identifying the range in which the arithmetic mean falls, the authors was able to determine the respondent’s level of agreement. The authors first analysed the arithmetic mean for the whole population. Then, they analysed how the arithmetic mean changed according to the demographics.

The Kruskal-Wallis Test (sometimes also called “one-way ANOVA on ranks”) is a non-parametric test used to determine if there are statistically significant differences between the groups of each demographic in terms of their answer to questions. In order to carry out this test, the authors assumed that the observations are independent of one another, the measurement scale for the dependent variable is ordinal and the samples are randomly chosen (Goldstein, 2012).

In order to use the Kruskal-Wallis Test, the authors created the null and alternative hypotheses. The null hypothesis is that the distribution of Statement 2.1, 2.2, 2.3, 2.4, 2.5, 3.1, 3.2, 3.3, 3.4, 3.5, 4.1, 4.2, 4.3, 4.4 and 4.5 is the same across categories of Questions 1.1, 1.2, 1.3 and 1.5.

On the other hand, the alternative hypothesis is that the distribution of Statements 2.1, 2.2, 2.3, 2.4, 2.5, 3.1, 3.2, 3.3, 3.4, 3.5, 4.1, 4.2, 4.3, 4.4 and 4.5 is not the same across categories of Questions 1.1, 1.2, 1.3 and 1.5.

The null hypothesis for each statement will be accepted if the p-value exceeds the level of significance (α=0.05). If the p-value is less than the significance level (α=0.05), the null hypothesis will be rejected.

The thematic approach was used to analyse the data collected from the comment boxes by categorisingthem into themes and analysing them accordingly. Braun et al. (2014) consider thematic analysis as a method used in qualitative data to identify, analyse and interpret themes.

4. Results, Findings & Analysis

A total sample of 384 surveys was collected amongst Maltese nationals which is a representative sample of the whole population, i.e., 475,000 nationals. The majority of the participants (69.53%) were females whereas 29.95% were males. Just over half of a percentage (0.52%) declared their gender as ‘Other’.

The highest number of participants were within the age group 18-24 years old which amounted to 34.11% of the whole population. This was followed by the age group 35-44 years old (22.14%), 25-34 years old (20.31%), 45-54 years old (13.80%), 55-64 years old (6.51%) and 65+ (3.13%) respectively.

The majority (59.64%) of the Maltese nationals in this study had not heard about the term ‘bancassurance’. Only 40.36% of the whole population declared that they heard about the term ‘bancassurance’.

38.14% of the participants who had heard about the term ‘bancassurance’ had done so from bank personnel. This was followed by the media (26.29%), school (15.98%), agents/brokers/intermediaries (9.79%) and friends/relatives (7.22%) respectively. There were 2.58% of the participants who declared that they had heard about the term ‘bancassurance’ from their workplace.

The majority of the population (82.03%) are not bancassurance clients. In fact, only 17.97% are bancassurance clients. This could be the reason for the lack of knowledge on bancassurance which, as stated earlier, was high amongst participants (59.64% of the population declared that they had never heard about the term ‘bancassurance’).

We have seen above that self-perception can be used as a marketing tool to persuade customers to purchase a product or service by observing their behaviour (Snyder & Cunningham, 1975). Under this section, the authors were concerned with factors that motivate the customer to purchase insurance products from banks. These include advertisements, trust, the bank’s understanding of client needs and financial position, obligation, the bank’s brand image and the fact that it is well known.

a) Advertisements

Descriptive statistics revealed that the participants were uncertain (M=2.78) about whether or not advertisements motivate them to purchase insurance products from banks. The result remained the same amongst the genders (males; M=2.73, females; M=2.80, other; M=3.00), amongst those who had heard about the term ‘bancassurance’ (M=2.90) and those who had not (M=2.69) and between those who are bancassurance clients (M=2.97) and those who are not (M=2.74).

However, analysing the mean between the different age brackets shows that those aged between 55-64 years old (M=2.56) and over 65 years old (M=2.50) disagreed that advertisements motivate them to purchase insurance products from banks. The remaining age brackets; 18-24 years old (M=2.82), 25-34 years old (M=2.73), 35-44 years old (M=2.91) and 45-54 years old (M=2.70) were uncertain. In Chapter 2 (Section 2.8.1.2), it was argued that if a customer does not pay attention to a marketing stimulus, the message that the company tries to portray becomes pointless (Mostert, 1996). This agrees with the descriptive statistics results since the participants are either uncertain or disagree with the statement that advertisements motivate them to purchase insurance products from banks.

b) Participant’s Trust on Banks

Participants agreed that they trust their respective banks and hence they might purchase insurance products from them (M=3.46). In fact, research has shown that in order to purchase a product or service from the bank, the customer must have complete confidence in the bank since they are going to trust their money to a third party (Ghimire, 2013).

Analysing the mean between the genders shows that males (M=3.27) and others (3.00) were uncertain while females (M=3.55) agreed that they might purchase insurance products based on their trust in the bank. Descriptive statistics between the age brackets revealed that those aged between 18-24 years old (M=3.31) and between 55-64 years old (M=2.92) were uncertain while those aged between 25-34 years old (M=3.49), between 35-44 years old (M=3.72), between 45-54 years old (M=3.64) and over 65 years old (M=3.50) agreed that they have trust in banks meaning that they might purchase insurance products from them.

The mean between those who heard about the term ‘bancassurance’ (M=3.51) and those who didn’t (M=3.43) remained the same as the whole population. The participants who are bancassurance clients (M=3.77) agreed with the whole population whereas those who are not bancassurance clients (M=3.39) were uncertain about whether they would purchase insurance products from banks based on their trust in the bank.

c) Bank’s Understanding of one’s own needs and financial position

Fields et al (2007b) argued that banks have more up-to-date client information since they provide services to their customers directly. This means that banks are better at understanding the customer’s needs and financial position. However, descriptive statistics revealed that participants were uncertain about whether they would purchase insurance products from their bank because the bank has a better understanding of their needs and financial position (M=3.24). Almost across all demographic questions, the result remained the same. However, the mean changed between those who are bancassurance clients (M=3.58) agreeing to purchase insurance products from their bank because the bank better understands their needs and financial position. This corroborates the findings presented by Fields et al (2007b).

d) Obligation

Participants were uncertain about whether they would only purchase insurance products from the bank if the bank obliges them to do so (M=3.35). Analysing the mean between the genders, males (M=3.37) and females (M=3.34) agreed with the whole population. However, others (M=4.00) agreed to statement 2.4 i.e., that they will only purchase insurance products from banks if they are obliged to do so. Participants aged between 18-24 years old (M=3.40), between 45-54 years old (M=3.08), between 55- 64 years old (M=3.20) and over 65 years old (M=3.17) were uncertain about statement 2.4. However, those aged between 25-34 years old (M=3.46) and between 35-44 years old (M=3.41) agreed that they would only purchase insurance products from the bank if the bank obliges them to do so. Both those participants who heard about the term ‘bancassurance’ (M=3.28) and those who had not (M=3.40) were uncertain about statement 2.4. This also applies to those who are bancassurance clients (M=3.39) and those who are not (M=3.39).

e) Bank’s brand image and well-known

Descriptive statistics revealed that participants agreed that they were uncertain about whether they would purchase insurance products from their banks based on the bank’s brand image and the fact that it is well known (M=3.10). The results remained the same amongst the genders (males; M=3.09, females; M=3.11, other; M=3.00), the age brackets (18-24; M=2.89, 25-34; M=3.22, 35-44; M=3.22, 45-54; M=3.38, 55-64; M=2.84, 65+; M=3.17), between those who had heard about the term ‘bancassurance’ (M=3.17) and those who had nothad not (M=3.05) and between those who are bancassurance clients (M=3.32) and those who are not (M=3.05).

As stated above, it was argued that price perception is all about the customer’s attraction to a price (Janiszewski & Lichtenstein, 1999). Under this section, the statements related to the premium in whether it is economical to purchase insurance products from banks, costs, satisfaction and the processing time to purchase.

a) Premium

Studies have shown that through bancassurance, customers benefit from lower premium rates (Ghimire, 2013). However, descriptive statistics revealed that the participants were uncertain on whether the premium charged on insurance products is fair and reasonable (M=3.05). The result remained the same across genders (males; M=3.00, females; M=3.07, other; M=3.00), ages (18-24; M=3.01, 25-34; M=3.23, 35-44; M=3.11, 45-54; M=2.98, 55-64; M=2.64, 65+; M=3.08), between those who had heard about the term ‘bancassurance’ (M=3.12) and those who had not (M=3.00) and between those who are bancassurance clients (M=3.23) and those who are notare not (M=3.01).

b) Economical

Participants do not know whether purchasing insurance products from banks is economical or not (M=3.07). The result remained the same across genders (males; M=3.04, females; M=3.09, other; M=3.00), ages (18-24; M=3.10, 25-34; M=3.12, 35-44; M=3.05, 45-54; M=3.11, 55-64; M=2.72, 65+; M=3.25), between those who had heard about the term ‘bancassurance’ (M=3.14) and those who had nothad not (M=3.03) and between those who are bancassurance clients (M=3.26) and those who are not (M=3.03).

c) Costs

Descriptive statistics showed that the participants do not know whether costs are reduced when purchasing insurance from banks (M=2.88). There weren’t any changes in the results between the genders (males; M=2.94, females; M=2.85, other; M=3.00), ages (18-24; M=2.98, 25-34; M=2.90, 35- 44; M=2.80, 45-54; M=3.00, 55-64; M=2.72, 65+; M=3.08), between those who had heard about the term ‘bancassurance’ (M=2.92) and those who had not (M=2.85) and between those who are bancassurance clients (M=2.88) and those who are not (M=2.88). However, research has shown that when a customer purchases an insurance product from a bank rather than from an insurer, the distribution costs will decrease (Ghimire, 2013).

d) Satisfaction

Blank (n.d.) argued that price perception is also about customer satisfaction upon purchasing the product. Descriptive statistics revealed that the participants were uncertain about whether their satisfaction with the bank’s services motivates them to purchase insurance products from them (M=3.35). The mean result between the genders remained the same (males; M=3.30, females; M=3.38, other; M=3.00).

Participants aged between 25-34 years old (M=3.44), 35-44 (M=3.44) and between 45-54 years old (M=3.55) agreed to statement 3.4 i.e., that they would purchase insurance products from banks because they are satisfied with the bank’s services. On the other hand, participants aged between 18-24 years old (M=3.24), between 55-64 years old (M=3.00) and over 65 years old (M=3.33) were uncertain. Both the participants who had heard about the term ‘bancassurance’ (M=3.39) and those who had not (M=3.33) were uncertain about whether they would purchase insurance products based on their satisfaction with the bank’s services.

Kavugwi (2015) stated that since a bank has access to a larger product range to sell, customers will be more attractive to a bank and hence customer satisfaction will increase. This is in line with the participants who are bancassurance clients since they agreed (M=3.61) to statement 3.4 whereas those who are not bancassurance clients stated that they were uncertain (M=3.30).

e) Quick and efficient processing time

Research has shown that in order to increase efficiency, a bank needs to expand its products and services, by instance, selling insurance products (Bergendahl, 1995). However, participants were uncertain (M=3.29) about whether the processing time to purchase an insurance product from a bank is quick and efficient. Both males (M=3.17) and females (M=3.34) were uncertain whereas, others (M=3.50) agreed that the processing time is quick and efficient.

Participants aged between 25-34 years old (M=3.42) and between 35-44 years old (M=3.47) agreed that the processing time is quick and efficient. On the other hand, participants aged between 18-24 years old (M=3.18), between 45-54 years old (M=3.19), between 55-64 years old (M=3.12) and over 65 years old (M=3.08) were uncertain. Descriptive statistics revealed that participants who had heard about the term ‘bancassurance’ agreed (M=3.41) that the processing time is quick and efficient while those who had never heard about the term ‘bancassurance’ were uncertain (M=3.21). Participants who are bancassurance clients agreed (M=3.54) to this statement, whereas those who are not bancassurance clients were uncertain (M=3.23).

4.3.1.3 Benefit/Risk Perception

As noted above, the aim of a company is to convince the customer that the product or service that they are willing to purchase is right and adequate for them (Blank, n.d.). Under this section, the statements deal with the benefits or risk that the customer faces when purchasing insurance products from banks.

a) Convenience

Descriptive statistics revealed that participants agreed (M=3.53) that it is convenient to purchase insurance products from banks. Both males (M=3.54) and females (M=3.52) agreed to this statement. However, others (M=3.00) were uncertain.

Participants aged between 18-24 years old (M=3.51), between 25-34 years old (M=3.59), between 35- 44 years old (M=3.54), between 45-54 years old (M=3.53) and over 65 years old (M=3.50) agreed that it is convenient to purchase insurance products from banks whereas those aged between 55-64 years old (M=3.36) were uncertain. Both participants who had heard about the term ‘bancassurance’ (M=3.62) and those who had not (M=3.46) agreed that it is convenient to purchase insurance products from banks. This also applies to those who are bancassurance clients (M=3.83) and those who are not (M=3.46).

b) One-Stop-Shop

Participants agreed that the idea of having access to both financial and insurance products from one institution only motivates them to purchase insurance products from banks because it saves them time (M=3.79). In fact, studies have shown that by acting as a ‘one-stop-shop’, a bank increases its customer satisfaction (Alavudeen & KD, 2015) while the customer benefits from having access to a variety of products under one roof (Sinha, 2005).

Males (M=3.80) and females (M=3.79) agreed to this statement whereas others (M=3.00) were uncertain. Analysing the mean between the different age brackets revealed that only those aged between 55-64 years old (M=3.36) were uncertain whereas the other age brackets (18-24; M=3.73, 25-34; M=3.87, 35-44; M=3.86, 45-54; M=3.98, 65+; M=3.42) agreed that the idea of having access to both financial and insurance products from just one institution motivates them to purchase insurance products from banks. Both participants who had heard about the term ‘bancassurance’ (M=3.90) and those who had not (M=3.71) agreed to this statement. Also, both participants who are bancassurance clients (M=4.16) and those who are not (M=3.70) have agreed that the idea of a one-stop-shop motivates them to purchase insurance products from banks.

c) The process of a claim takes too long

Descriptive statistics revealed that participants were uncertain (M=3.16) about whether the time for a claim to be settled is long through the bank. Males (M=3.17) and females (M=3.15) agreed with the whole population. However, others (M=3.50) agreed to Statement 4.3, i.e., that a claim settlement takes long. Participants across all ages were uncertain to Statement 4.3 (18-24; M=3.13, 25-34; M=3.22, 35- 44; M=3.18, 45-54; M=3.09, 55-64; M=3.20, 65+; M=3.17). This is also applicable to those who had heard about the term ‘bancassurance’ (M=3.19) and those who had not (M=3.14) and to those who are bancassurance clients (M=3.17) and those who are not (M=3.16).

d) Setting up a private pension plan

Studies have shown that changes in lifestyle and in culture have led to an increase in the need for a private pension plan (Sinha, 2005). In fact, participants agreed that setting up a private pension plan gives them peace of mind that when they retire, they will have enough money to live (M=3.72). There weren’t any changes between the genders (males; M=3.59, females; M=3.78 and others; M=4.00), the ages (18-24; M=3.89, 25-34; M=3.81, 35-44; M=3.53, 45-54; M=3.53, 55-64; M=3.68, 65+; M=3.75), between those who had heard about the term ‘bancassurance’ (M=3.65) and those who had not (M=3.77) or between those who are bancassurance clients (M=3.51) and those who are not (M=3.77).

e) Purchasing Life Insurance

Participants agreed that purchasing life insurance gives them peace of mind that if they die, their dependents will be financially protected (M=3.88). There weren’t any changes between the genders (males; M=3.83, females; M=3.90, others; M=4.00), the ages (18-24; M=3.95, 25-34; M=3.96, 35-44; M=3.94, 45-54; M=3.68, 55-64; M=3.64, 65+; M=3.58), between those who had heard about the term ‘bancassurance’ (M=3.87) and those who had not (M=3.89) or between those who are bancassurance clients (M=4.01) and those who are not (M=3.85). In fact, these results corroborate those presented by Munich Re (2001) who revealed that nowadays customers prefer to purchase life insurance products rather than depositing money in a savings account (Munich Re, 2001).

The Kruskal-Wallis test (also called “one-way ANOVA on ranks”) is a non-parametric test used to determine if there are statistically significant differences between the groups of each demographic section for each statement.

The null hypothesis for each statement will be accepted if the p-value exceeds the level of significance (α=0.05). Otherwise, the null hypothesis will be rejected.

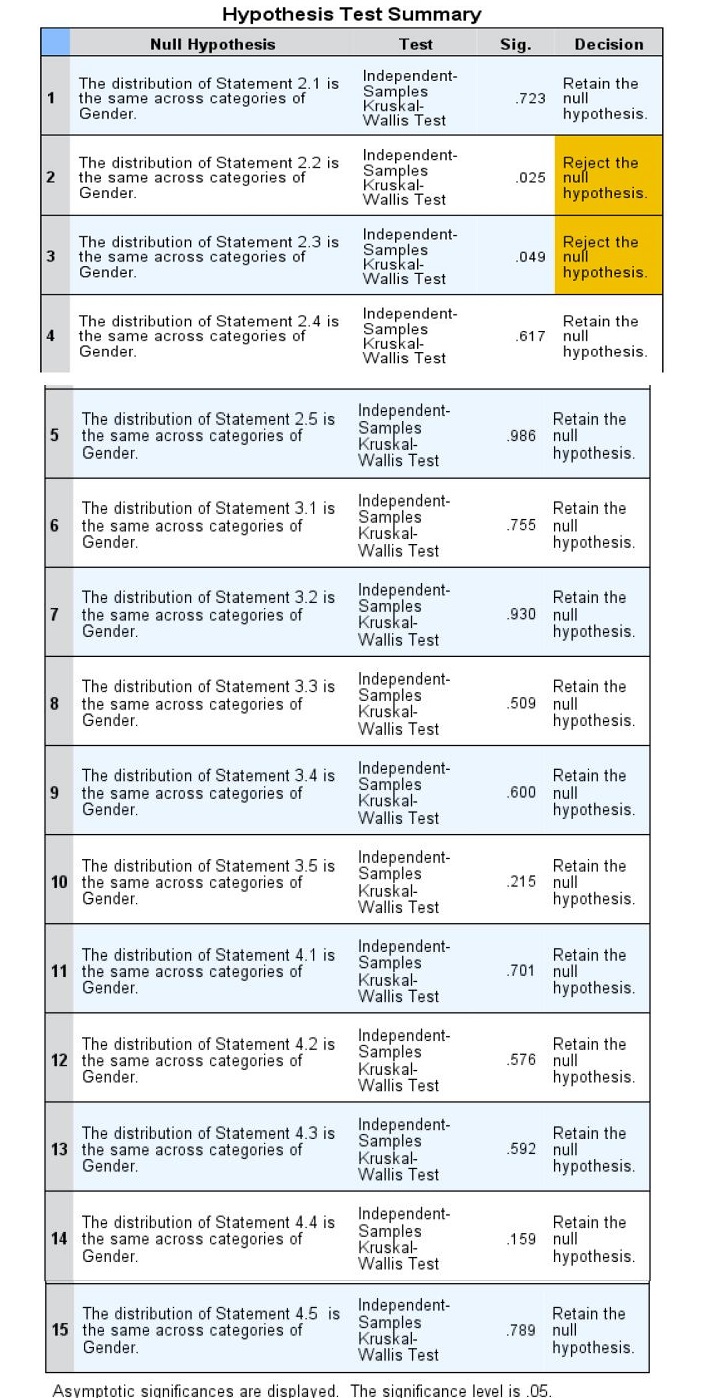

(a) Genders

The authors compared the genders (Q1.1) for each statement where Table 3 shows the results obtained from the Kruskal-Wallis test. Since the p-value for all the statements except for statements 2.2 and 2.3 is greater than the significance level (α=0.05), the authors did not reject the null hypothesis. This means that there is no statistically significant difference in the groups representing the genders. Therefore, one must conclude that gender does not influence the customer’s perception of bancassurance.

On the other hand, since statement 2.2 and statement 2.3 have a p-value of 0.025 and 0.049 respectively, which is less than the significance level (α=0.05), the authors rejected the null hypothesis for these statements. This means that there is a statistically significant difference in the groups representing gender. Therefore, one must conclude that gender does influence the customer’s perception as to whether one would purchase insurance products based on the trust one has in the bank (statement 2.2) and whether one would purchase insurance products because the bank better understands their needs and financial position (statement 2.3).

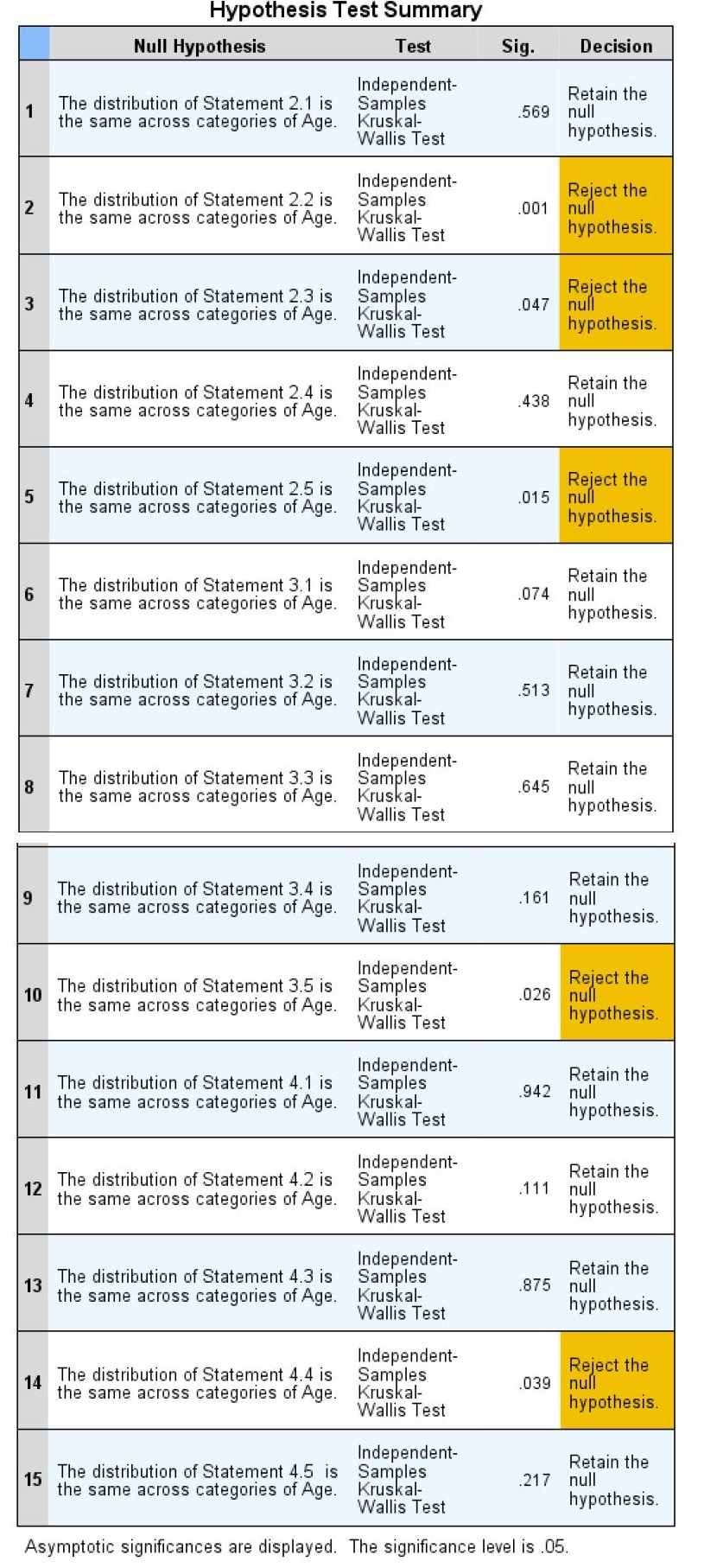

(b) Age

The authors also compared the age (Q1.2) for each statement where Table 4 shows the results obtained from the Kruskal-Wallis test. Since the p-value for all the statements except to Statements 2.2, 2.3, 2.5, 3.5 and 4.4 is greater than the significance level (α=0.05), the authors did not reject the null hypothesis.

This means that there is no statistically significant difference in the groups representing age. Therefore, one must conclude that age does not influence the customer’s perception of bancassurance.

On the other hand since Statements 2.2, 2.3, 2.5, 3.5 and 4.4 have a p-value of 0.01, 0.047, 0.015, 0.026 and 0.039 respectively, which are less than the significance level (α=0.05), the authors rejected the null hypothesis for these statements. This means that there is a statistically significant difference in the groups representing age. Therefore, one must conclude that the age does influence the customer’s perception as to whether they would purchase insurance products based on the trust they have in their bank (statement 2.2) as well as based on the fact that the bank will better understand their own needs and financial position (statement 2.3). Age also influences the customer’s perception as to whether they would purchase insurance products based on the bank’s brand image and the fact that the bank is well known (statement 2.5) and whether the processing time to purchase an insurance product from a bank is quick and efficient (statement 3.5). It was also concluded that age does influence the customer’s perception as to whether they would set up a private pension plan to have peace of mind that when they retire (statement 4.4).

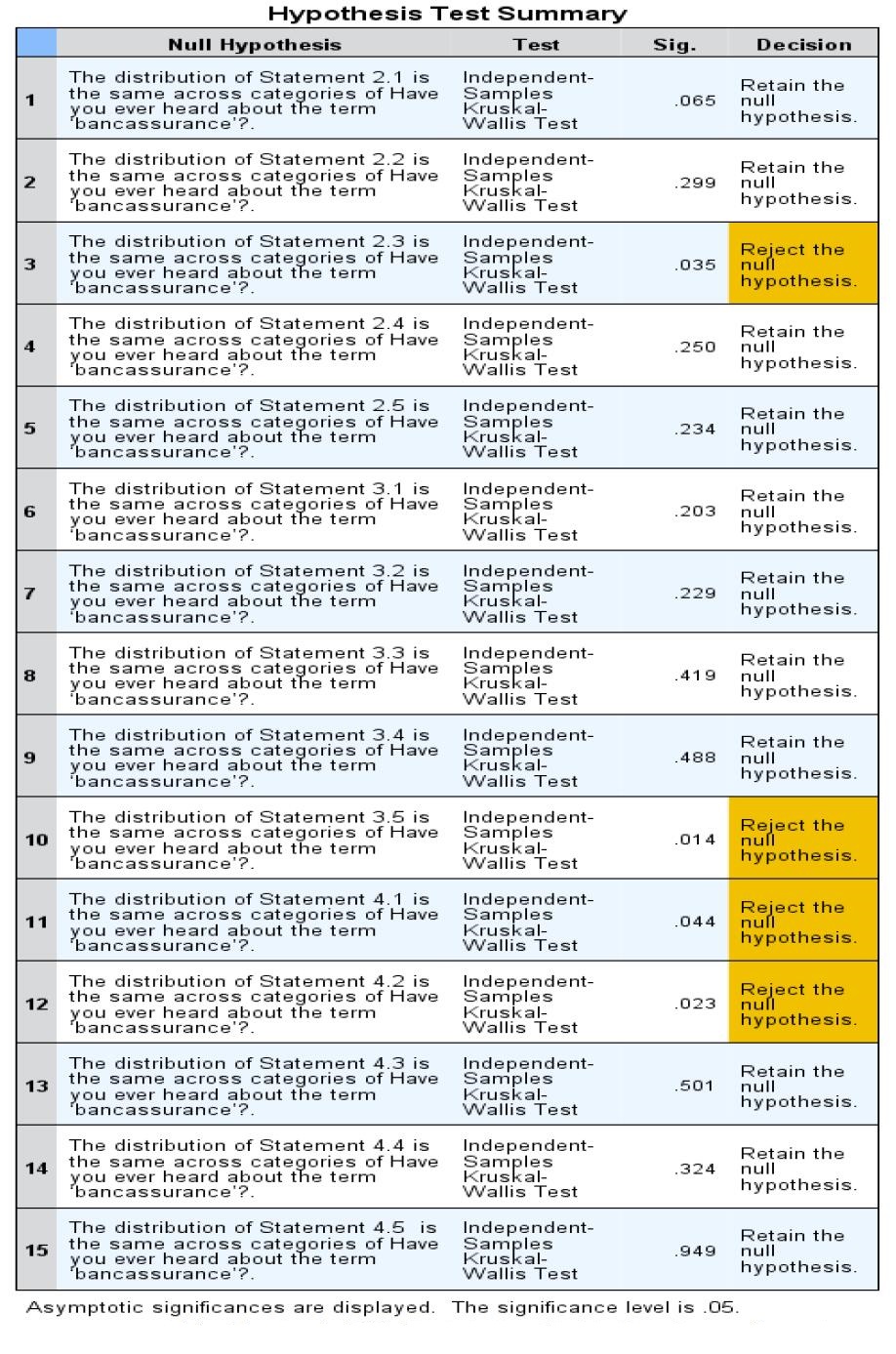

(c) The extent to which participants heard about the term ‘bancassurance’

The Kruskal-Wallis test was also used to compare the participants who had heard about the term ‘bancassurance’ and those who had not (Q1.3), for each statement. Table 5 shows the results obtained from the Kruskal-Wallis test. The null hypothesis for all the statements except statements 2.3, 3.5, 4.1 and 4.2 were not rejected. This is because the p-value was greater than the significance level (α=0.05). Hence, this means that there is no statistically significant difference between the groups who had heard about the term ‘bancassurance’ and those who had not. Hence, the extent to which one has ever heard about the term ‘bancassurance’ does not influence the customer’s perception of bancassurance.

The p-values for statements 2.3 (p=0.035), 3.5 (p=0.014), 4.1 (p=0.044) and 4.2 (p=0.023) are less than the significance level (α=0.05) hence, the null hypothesis was rejected. Therefore, there is a statistically significant difference in the groups in terms of whether the term ‘bancassurance’ was ever heard or not. Hence, one must conclude that the extent to which one has ever heard about the term ‘bancassurance’ does influence the customer’s perception as to whether they would purchase insurance products from banks based on the fact that the bank will better understand their needs and financial position (statement 2.3). The extent to which one has ever heard about the term ‘bancassurance’ also influences the customer’s perception as to whether the processing time to purchase an insurance product form a bank is quick and efficient (statement 3.5) and whether is it convenient to purchase insurance products from banks (statement 4.1). Customer perception is also influenced by the idea that by having access to both financial and insurance products from one institution only (one-stop-shop), it will save them time.

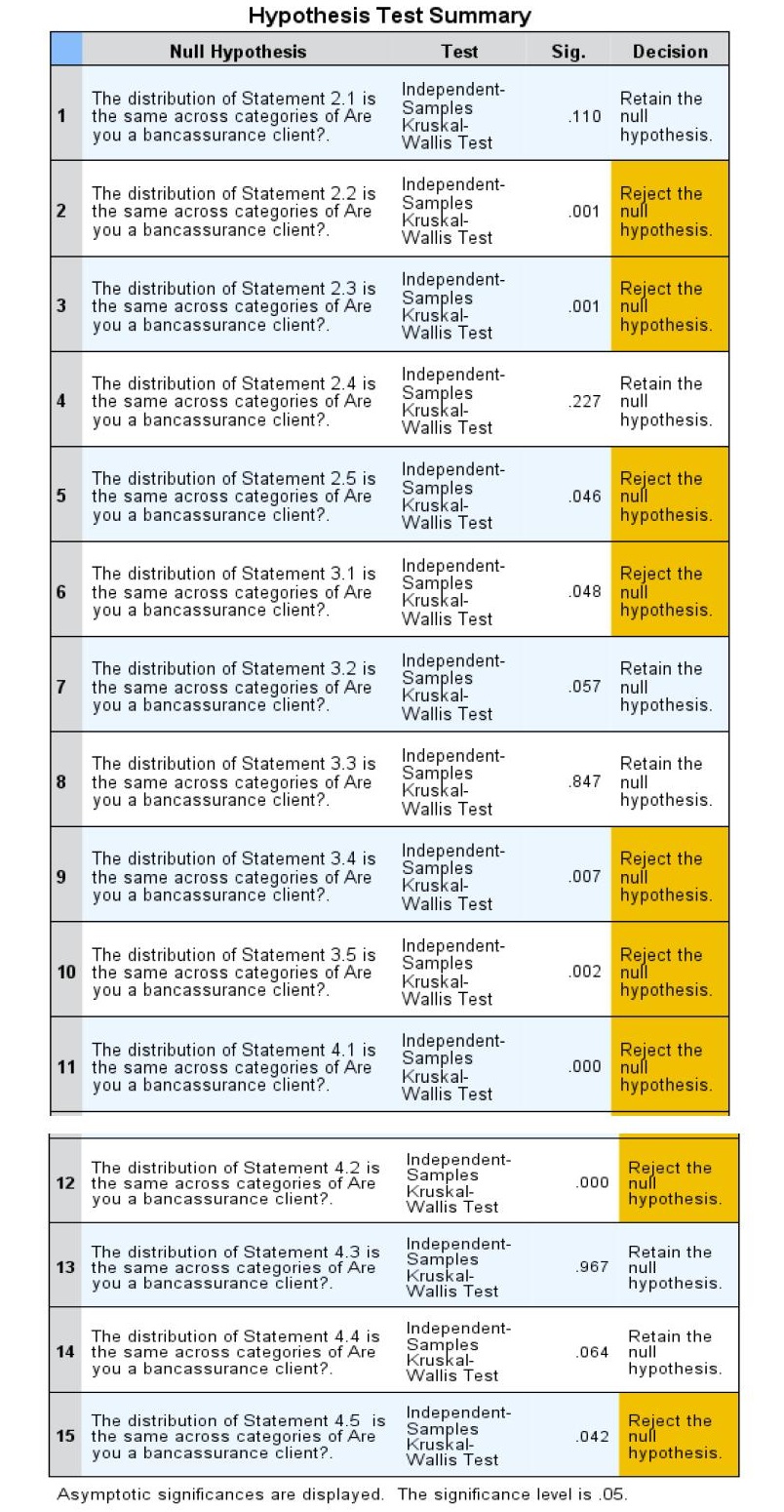

(d) Bancassurance Clients

The authors also used Kruskal-Wallis test to compare the participants who are bancassurance clients and those who are not (Q1.5) for each statement. As can be seen in Table 6 only the null hypothesis for statements 2.1, 2.4, 3.2, 3.3, 4.3, and 4.4 was not rejected. This is because p-values were greater than the significance level (α=0.05). Hence, there is no statistically significant difference in the groups representing whether the participant is a bancassurance client or not. Therefore, it can be concluded that whether one is a bancassurance client or not does not influence the customer’s perception of bancassurance.

On the other hand, statements 2.2, 2.3, 2.5, 3.1, 3.4, 3.5, 4.1, 4.2, and 4.5, were all rejected. This is because their p-values (0.001, 0.001, 0.046, 0.048, 0.007, 0.002, 0.000, 0.000 and 0.042 respectively) were less than the significance level (α=0.05). Thus, there is a statistically significant difference in the groups representing whether one is a bancassurance client or not. This means that it can be concluded that whether one is a bancassurance client or not does influence the customer’s perception as to whether they would purchase insurance products from banks based on the trust they have in their bank (statement 2.2) and the fact that the bank better understands one’s own needs and financial position (statement 2.3). These results also show that it also influenced whether they would purchase insurance products based on the bank’s brand image and the fact that the bank is well known (statement 2.5).

Customer perception is also influenced by whether the premium to purchase an insurance product is fair and reasonable (statement 3.1), whether clients would purchase insurance products from a bank based on their satisfaction with the bank’s services (statement 3.4) and whether the processing time to purchase an insurance product from a bank is quick and efficient (statement 3.5). It is also influenced by whether the purchasing of an insurance product from a bank is convenient (statement 4.1) and as to whether they would purchase insurance products from a bank based on the idea that by having access to both financial and insurance products from one institution only (one-stop-shop) saves them time (statement 4.2). Finally, whether one is a bancassurance client or not influences customer perception as to whether they would purchase life insurance to have peace of mindthat their dependents will be financially protected should they die (statement 4.5).

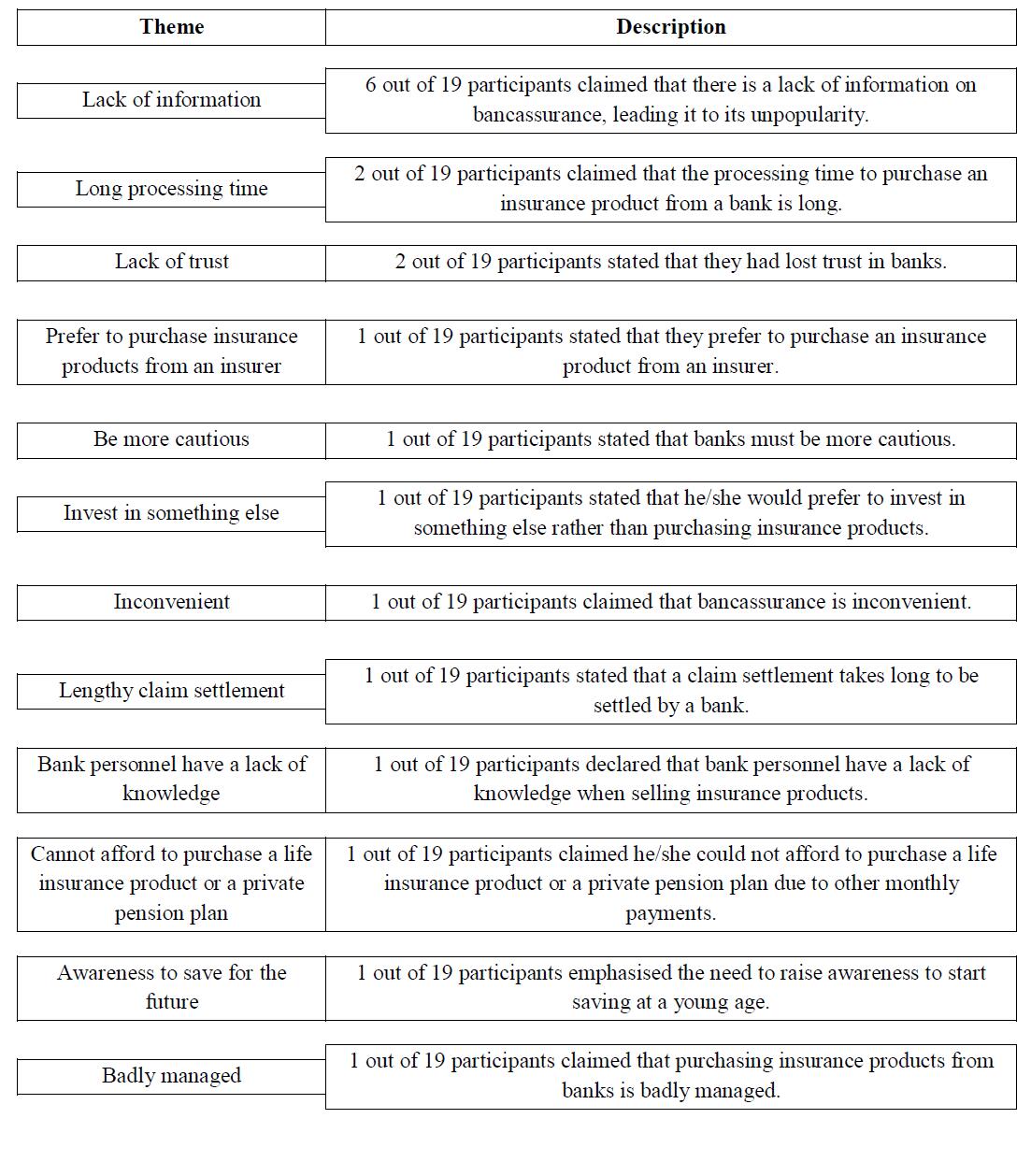

As discussed in Chapter 3, at the end of the questionnaire the authors included a comment box where the participants had the opportunity to add any additional comments that they felt were relevant to the subject. To analyse these comments, thematic analysis was used. Out of the 384 participants, only 19 left a comment (Table 7).

A theme which emerged from the comment boxes was the lack of information on bancassurance. A participant claimed that banks do not promote such services, such that people are unaware of bancassurance. This participant also added that the majority of the public prefer to purchase insurance products directly from an insurer rather than from a bank. Another participant emphasised that bancassurance is unpopular due to lack of information and the fact that only life insurance and/or private pension plan can be purchased. In his/her opinion, bancassurance can become popular if the bank starts selling non-life insurance products.

Another theme which emerged was that the processing time for purchasing an insurance product from a bank is long. A participant stated that although there is the concept of a one-stop-shop when purchasing insurance products from a bank, the processing time is long. Hence, he/she stated that it is inconvenient. Two participants claimed that they had lost trust in banks. One of these participants emphasised that he/she lost trust in local banks and hence it is better to purchase insurance products from an insurer. The other participant stated that he/she lost trust in banks due to mishandling of his/her assets where he/she lost money. Adding to this, a participant claimed that banks must be more cautious in their work.

Another theme which emerged from the comment boxes was personal preference. Specifically, one participant stated that he/she prefers to invest his/her money in bonds or equities rather than purchasing insurance products. A participant claimed that he/she is concerned about whether the bank employs personnel that really know about insurance. This is because in his/her opinion if a person goes to purchase an insurance product from a bank, the personnel does not really explain all the options available. It was also stated that if a claim arises when the insurance product is purchased from a bank, the process to settle such a claim takes longer than if a claim arises when the insurance product is purchased from an insurer.