Acadlore takes over the publication of JAFAS from 2023 Vol. 9, No. 4. The preceding volumes were published under a CC BY license by the previous owner, and displayed here as agreed between Acadlore and the owner.

The Viability of Tax E-services in Ensuring Taxpayer Compliance and Its Impact on Revenue Collection: A Case Study of ZIMRA

Abstract:

The study sought to investigate the viability of tax e-services in ensuring tax compliance and increased revenue collection using ZIMRA Harare headquarters as a case study. Scholars shared their different ideas regarding the relationship between tax e-services and tax compliance and most of them were in agreement that the two variables yield a positive relationship. The descriptive design, which is a component of the mixed approach, was adopted since it incorporates both quantitative and qualitative approaches. Questioners and interviews were used to collect data. The results revealed that there is a positive relationship between e-filing, revenue collection and tax compliance. It emerged that e filing, tax compliance and revenue collection have a strong positive relationship. Companies should adopt the electronic tax filing system to enable better tax compliance levels and revenue collection.

1. Introduction

Wasao (2014), Sifile et al (2018), Mukuwa and Phiri (2020), Irefe-Esema and Akinmade (2020), Odongo (2016) and Oladele et al (2020) postulated that “the adoption of tax e-services have a positive relationship with compliance by taxpayers”. According to Atlantis Press (2018), “the implementation of e-filing, the understanding of tax, and tax penalty on proper compliance of individual taxpayers all have a positive relationship.” Masunga et al (2020) was “in agreement with the positive impact that has been brought by the use of tax e-services but his focus was on how the adoption of tax electronic services had positively affected revenue generation”. In support of this idea, David (2019) suggested that “internet payment/filing system facilitates registration of tax payers and allows clients to pay taxes easily from any place by use of their mobile phones and thus increasing revenue generation”.

On the other hand, Ofurum (2018) and Joseph (2018) claimed that “electronic taxing has not increased tax revenue”. They went on to say that “the benefits that are generated from the use of tax electronic services are outweighed by the costs of implementing such services”. Hossain and Azam (2019) stated that “from their research it was revealed that if the use of tax authority website requires less technical effort, then the people would be encouraged to use e-tax filing”. “So, the relationship between tax payer compliance and introduction of tax electronic services was dependent on whether the systems are user friendly or not”. Coolidge and Yilmaz (2014) stated that “e-filers generally spend more time in tax compliance activities which unnecessarily add to compliance costs”. Defitri and Fauziati (2018) based their research on the effect that demographic features and the use of e-filing has on compliance by taxpayers and the results showed that “both demographic factors and e-filing have a negative relationship with tax compliance”. Hambali (2020) stated that“the rate of success of e-filing is defined by the intentions of the users andcontentment from users as evidenced by advantages provided through the usage of e-filing systems”. Johnson (2021) defined electronic filing as” a method of filing taxforms through the internet with the help tax filing software that has been certified bythe appropriate tax body”. Zimbabwe Revenue Authority (ZIMRA) commenced use ofe-services on the 26th of June 2015.” E-services enables online application of businesspartner numbers, e-filing of tax returns, online application of tax clearance certificateand display of statement of account.” The aim was to increase compliance bytaxpayers. “Zimbabwe Revenue Authority has a duty to collect taxes and othersources of revenue for the Zimbabwean government. Its authority stems from theRevenue Authority Act, which was established by Zimbabwe's parliament in 2002, aswell as other relevant legislation” Wadesango et al 2020. “ZIMRA is also tasked tominimise smuggling and illegal trade. The authority regulates imports, exports and exchange control” Mapope (2021). Mapope further asserts that “according to 2015 revenue performance report, the goal of ZIMRA was stated which is optimising revenue collection and ensuring a secure supply chain. Tax is considered as a fundamental aspect of modern life since it provides revenue that is used to pay many vital public goods and services. Failure by ZIMRA to collect revenue leads to the government failing to meet its capital expenditures and recurrent expenditures hence individual and company taxes need to paid”.

It is postulated that “in the 2015 revenue performance report, the then ZIMRA board chairman, Mrs Bonyongwe anticipated a rise in the revenue collection and costs reduction in the following year due to automation. Her assumption was made holding other things constant, she did not incorporate other factors such as the business environment which has a huge impact on compliance and revenue collection” Mapope et al (2021).

According to Mapope (2021) “several individuals and companies failed to meet their tax payment and submission targets in 2015, 2016 and 2018 indicating widespread non-compliance despite the implementation of the e-services platform, whilst in 2017 and 2019 ZIMRA surpassed its targets”. Furthermore, they state that “regardless of ZIMRA surpassing its target, we still have a challenge because only thirty percent revenue is being collected. If 100% tax was collected the economy of Zimbabwe will not have been deteriorating because the government would have been able to cater for all its expenditures”.

According to Mhaka et al (2019), “as a result of non-compliance of taxpayers many tax heads failed to reach the target and resulted in company tax negative variances of 5.20% in 2015 and 7.01% in 2016. Penalties and interests are placed on ZIMRA clients if returns are not filed on time or if taxes are not paid on time. This has raised the amount owed to ZIMRA. Companies will be penalised $30 each day if they submit their tax returns after due dates”. “The rate at which taxpayers are failing to comply has had a severe impact on ZIMRA's revenue generation, resulting in the loss of a significant amount of revenue that could have been obtained” Mapope (2021). According to the same authors “the Revenue Performance Reports indicated that Individual tax had negative variances of 6.85% in 2015, 8.18% in 2016 and 0.68% in 2018. Although other years (2017 and 2019) surpassed the targets, the aim is 100% compliance from taxpayers. It was concluded that failure to exceed revenue targets in the years under study was attributed to difficult economic conditions and economic agents' refusal to meet tax responsibilities”.

2. Research Methodology

The study adopted a quantitative research approach. The sample size consisted of employees from the following departments: Electronic services 10, compliance department 5, management department 7, focalisation department 8 and human resources department 2. The research instruments used were questionnaires. Systematic application of statistical and logical techniques was used to analyse data.

3. Data Presentation and Analysis

Regression results

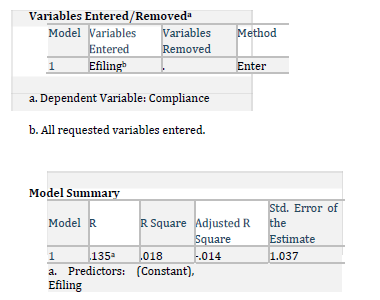

Impact of e-filing on tax compliance

According to Mapope (2021) “from the summary of the model summary above R-value is .135 and the R Square is .018 indicating that nearly 14 percent of the variability of tax compliance is accounted for by the predictor variable in the model. It means that tax compliance was influenced by 14 percent by e-filing adoption”.

The data shows that “the relationship between the independent variable (e-filing) and the dependent variable (tax compliance) was significant at 1.076, which is a sufficient tool to explain that e-filing adoption has a considerable impact on tax compliance”.

a.Dependent Variable: Compliance

Y=3.667+.275X

According to Mapope (2021), “two variables are included in the above function, demonstrating their positive association. E-filing and tax compliance are the variables”. According to them “the function's results show that if e-filing were kept fixed at zero, tax compliance would be 3.667, and a unit increase in e-filing would result in a factor of.275 increase in tax compliance among ZIMRA taxpayers. This demonstrates that e-filing and tax compliance have a positive association”.

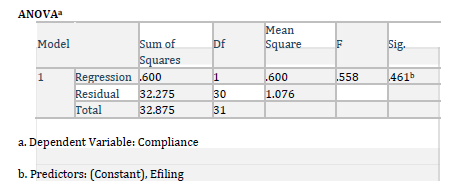

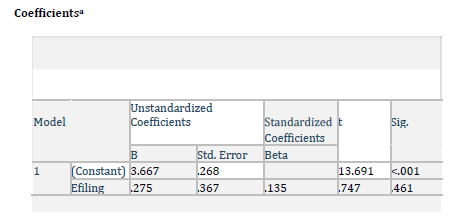

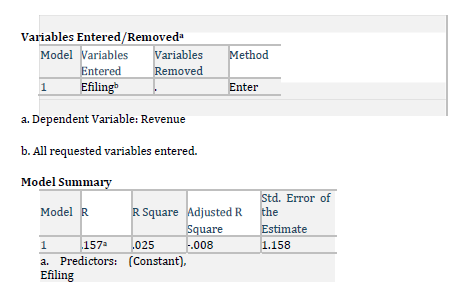

Impact of e-filing on revenue collection

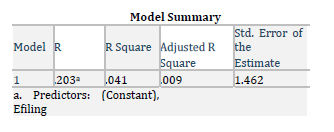

“The R-value is.157, and the R Square is.025 in the model summary, showing that the predictor variable in the model accounts for about 16 percent of the variability in revenue collection” (Mapope 2021). Furthermore, “It means that e-filing usage had a 16 percent impact on revenue collection”.

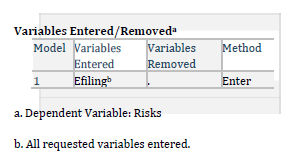

a. Dependent Variable: Revenue

b. Predictors: (Constant), Efiling

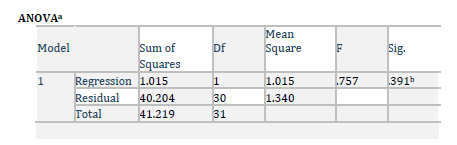

According to the given data, “the relationship between the independent variable (e-filing) and the dependent variable (revenue collection) was significant at 1.340, which is adequate to explain why e-filing adoption has a considerable impact on revenue collection”.

a. Dependent Variable: Revenue

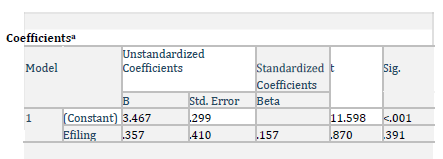

Y=3.467+.357X

As postulated and interpreted by Mapope (2021) “the above function includes two variables showing their positive relationship. The variables are e-filing and revenue collection. The function's results show that if e-filing were kept fixed at zero, revenue collection would be 3.467, and a unit increase in e-filing would result in a factor of.357 increase in revenue collection by ZIMRA. This confirms that a positive relationship exists between e-filing and revenue collection”.

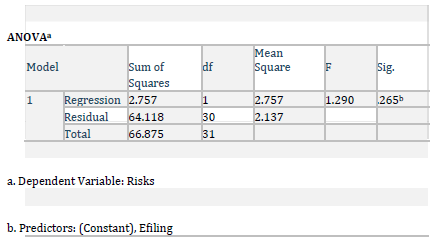

Impact of perception of security risks with e-filing on tax compliance

The model summary above shows that “the R-value is.203 and the R Square is.041, indicating that the predictor variable in the model accounts for around 20% of the variability in tax compliance. It suggests that the perception of security threats associated with e-filing adoption influenced tax compliance by 20%” Mapope (2021).

Interpreting the above information analysis of variance, Mapope (2021) assert that “the association between the independent variable (perception of security risks with e-filing) and the dependent variable (tax compliance) was significant at 2.137, indicating that the more taxpayers believe e-filing is related to security issues, the more tax compliance is affected.”

Y=3.000+.588X

“The above function includes two variables showing their negative relationship. The variables are people's perceptions of e-filing security threats and tax compliance” (Mapope 2021). They further postulate that “the function's results show that if perception of security risks with e-filing were set to zero, tax compliance would be 3.000, and a unit rise in perception of security risks with e-filing would result in a factor of.588 increase in non-compliance by ZIMRA taxpayers”. In the same vein they “confirm that a negative relationship exists between taxpayer perception of security with e-filing and tax compliance, in simple terms it means that the more taxpayers perceive security risks with e-filing adoption the more they become reluctant to comply with tax laws and regulations”.

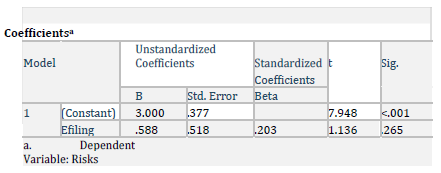

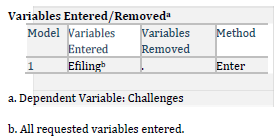

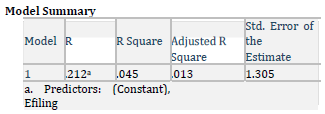

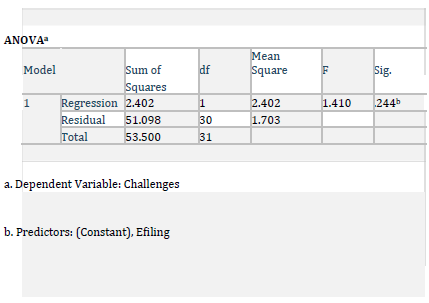

Impact of challenges of using electronic tax filing system on tax compliance

Interpreting the model above, the R-value is.212 and the R Square is.045, and this indicates that “the predictor variable in the model accounts for nearly 21% of the variability in tax compliance. It means that the difficulties encountered when using electronic tax filing influenced tax compliance by 21%”.

According to Mapope (2021) “from the above information analysis of variance shown that the association between the independent variable (challenges of using electronic tax filing) and the dependent variable (tax compliance) was significant at 1.703, which is enough to explain that the more the problems encountered when utilising an e-filing system, the greater the impact on tax compliance”.

a.Dependent Variable: Challenges

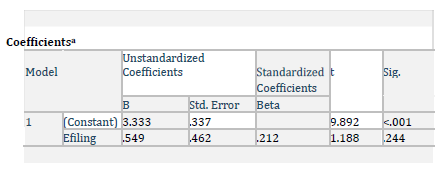

Y=3.333+.549X

Mapope (2021) postulate that “two variables are shown to have a positive relationship in the above function. The variables are challenges faced when using electronic filing system and tax compliance. According to the function's conclusions, the issues encountered when applying e-filing at zero constant tax compliance would be 3.333 and unit increase challenges faced when using e-filing would result in increased non-compliance by ZIMRA taxpayers by a factor .549”. Furthermore, they hint that “this confirms that a negative relationship exists between taxpayer challenges faced when using e-filing system and tax compliance, in simple terms it means that the more taxpayers face challenges when using the e-filing system the more they become reluctant to comply with tax laws and regulations”.

Data analysis results summarised

“Effect of e-filing on tax compliance

Effect of e-filing on revenue collection

Effect of perception of security risks associated with e-filing on tax compliance

Effect of challenges of using electronic tax filing system on tax compliance

H1 – Is there a correlation between electronic filing and tax compliance?

H2- Is there a correlation between e-filing and revenue collection

H3- Is there a correlation between security risks perception with e-filing and tax compliance

H4- Is there a correlation between challenges faced using electronic tax filing system and tax compliance”

Hypothesis | Regression | Beta | R2 | F | p-value | Hypothesis |

Weights | Coefficient | Supported | ||||

H1 | E-filing – | 0.275 | 0.018 | 0.558 | 0.461 | Yes |

tax | ||||||

compliance | ||||||

H2 | E-filing- | 0.357 | 0.025 | 0.757 | 0.391 | Yes |

revenue | ||||||

collection | ||||||

H3 | E-filing- | 0.588 | 0.041 | 1.290 | 0.265 | Yes |

security | ||||||

risks | ||||||

perception | ||||||

H4 | E-filing- | 0.549 | 0.045 | 1.410 | 0.244 | Yes |

challenges | ||||||

faced |

4. Discussion of Regression Tests Results

According to Mapope (2021) “from the regression tests carried out it was indicated that the introduction of electronic filing system causes an increase in tax compliance by taxpayers”. This is supported by Ekundina, (2018) saying “a way to accomplish higher voluntary compliance is through the adoption of e-filing system. It was also revealed that adoption of e-filing significantly causes a rise in revenue collected”. “The adoption of electronic tax filing and payment systems are important steps in achieving revenue collection targets for any government” (Sydney, 2017). “It was also shown that the more the taxpayers perceive that there are security risks due to using e-filing system the more reluctant they become to complying (Mapope, 2021). “Data privacy and data security are critical factors that should be given attention by organisations when adopting new technologies” (Haneem et al, 2019). Lastly, “the more the challenges faced by taxpayers when using the e-filing system the more they become unwilling to comply with tax rules and regulations” Mapope, (2021).

5. Conclusion

It was evidenced that “when there are system challenges taxpayers become reluctant to use the system because there is need to pay tax practitioners to help them in filing their returns. The other thing is if the system is congested during the deadlines it fails to accommodate the ever-increasing numbers of taxpayers at the same time which result in system hang ups that delay online filing”. “Another explanation for the low compliance rate is that taxpayers are concerned about the security risks connected with using electronic filing. Taxpayers are not comfortable with sharing their personal information such as credit cards because of the fear that the information may be handled unethically, and they also fear that their business information may be disclosed to their competitors” Mapope (2021). Furthermore, their conclusion shows that “the electronic filing system significantly affect tax compliance positively if it is operating without challenges. This has been proved by increase in taxpayer compliance levels through use of a paperless environment, filing of correct returns since the system auto rejects wrong information and give suggestions for change and timely payment of taxes be it PAYEE or income tax. The e-filing system has also reduced compliance costs to both tax administrators and taxpayers. Because both taxpayers and tax authorities find manual returns tedious to file and reconcile, e-filing was used to make work easier for both sides”.